Summary:

The proposal aims to introduce and deploy a new tokenomics for the PRL token, the possible future governance token of the Parallel Protocol.

Context:

In October 2024 we published a post in the governance forum, with the aim of discussing and exploring a potential new tokenomics for MIMO/PRL, the governance token of the Parallel. Following positive feedback from DAO members and a successful internal Proof-of-Concept we decided to develop the new tokenomics.

Introduced in 2021 with the launch of the Parallel protocol, the MIMO governance token and its token economics have enabled the beginning of protocol decentralization in an attempt to align the interests of users, MIMO token holders and the protocol. However, after more than 3 years in use, the model is showing its limitations. We are therefore proposing to revamp

Note: The approval of this proposal is conditioned to the approval of the MIMO token upgrade to PRL token proposal (which is not the case right now).

Rationale:

I. Overview:

(detailed diagram available here)

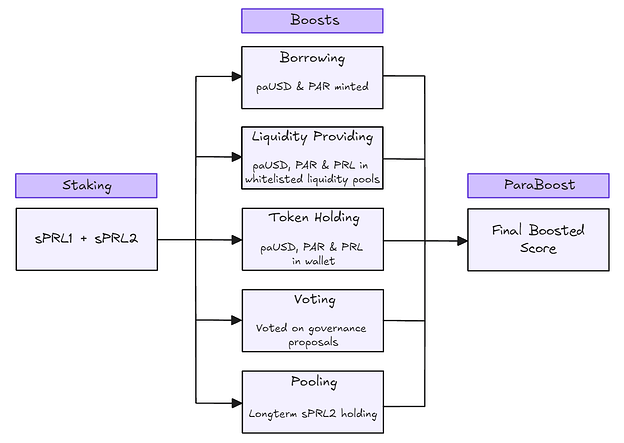

The new Parallel protocol tokenomics is a complete overhaul of the way PRL is involved in the economic and social operations of the protocol, with the aim of aligning the short-term and long-term interests of PRL users, holders and the protocol.

The biggest changes introduced are PRL staking; Parallel Boost (Paraboost), a new incentive model to reward positive externalities that benefit the protocol; and the distribution of revenues generated by the protocol to PRL stakers.

The technical implementation can be found here: GitHub - parallel-protocol/parallel-tokenomics

II. Epoch Concept:

The epoch will serve as the central unit of time in the new tokenomics. An epoch consists of a number of X days, we propose to set it to 30 days. It will be used to determine the ParaBoost calculation period, the duration of the cooldown during unstaking sPRL1 and sPRL2 and to manage the distribution of fees to sPRL1 and sPRL2 holders.

III. Staking Mechanisms:

We propose to give PRL holders the option of staking their tokens in 2 different forms: sPRL1, single PRL staking; and sPRL2, PRL/wETH 80/20 BPT staking. Each option allows holders to choose the risk they are willing to take.

sPRL1 & sPRL2 will be represented in form of tokens and will be freely transferable, however in case of transfer, the accumulated Paraboost will be lost (more details about Paraboost later in the post).

The PRL staking module can be deployed on several blockchains at once.

It will be possible for sPRL1 and sPRL2 to initiate unstaking at any time, against a cooldown period of 1 epoch. However, they will be able to bypass the vesting period by paying a penalty fee, starting at 50% and decreasing linearly over time. The penalty fee will be taken from the amount of SPRL1 or sPRL2 being unstaked and will be sent to the DAO Treasury.

- sPRL1: Single PRL Staking

A basic single-sided staking for users who do not want to take an impermanent loss from tokens in liquidity pools. Each PRL staked as sPRL1 will count as x1 voting power, with a 1 epoch unstaking cooldown.

We propose to initially deploy sPRL1 on:

- Ethereum

- Polygon PoS

- Base

- Sonic

Note: sPRL1 can technically be deployed on more chains in the future, conditioned to the availability of PRL on the chain.

- sPRL2: Liquidity Pool Staking

A PRL/wETH 80/20 Balancer Pool Token staking for users who want to get the maximum voting power. The staked LP as sPRL2 will itself be staked on Aura under the hood, with rewards in $BAL and $AURA automatically sent to the DAO treasury.

As these stakers help Parallel increase the PRL liquidity a x2.5 boost on the equivalent value of PRL tokens staked (in $) is applied. This boost will be applied for ParaBoost. sPRL2 holders will be able to unstake their BPT tokens against a 1 epoch unstaking cooldown.

We propose to initially deploy sPRL2 on:

- Ethereum

Note: sPRL2 can technically be deployed on more chains in the future, conditioned to the availability of PRL, Balancer/Beets & Aura on the chain.

IV. PRL Emissions:

Currently, 95% of MIMO token issuance (PRL tokens) is sent to the DAO treasury, while 5% is distributed to vMIMO holders. With vMIMO being discontinued, we propose to distribute 100% of the remaining inflation to the DAO treasury.

This will reduce net PRL inflation to 0%, reducing selling pressure to 0. The sPRL1 and sPRL2 will receive fees based on the revenues generated by the protocol (see below in the proposal).

V. ParaBoost:

Parallel Boost (ParaBoost) is a concept that distributes fees to PRL stakers who generate the most positive externalities that benefit the protocol.

This new concept aligns the short and long-term interests of both the protocol, by encouraging more use of it; PRL holders, by encouraging them to stake their tokens and interact with it; and ordinary users, encouraged to buy and stake PRL tokens to obtain additional benefits.

(ParaBoost Examples)

The ParaBoost will be computed offchain by a keeper at the end of an epoch and a merkle root is sent to the rewardDistributor contract. We propose to set Cooper Labs as the keeper of ParaBoost computation.

Due to time constraints (to get V3 out faster) we decided to simplify Paraboost as much as possible for tokenomics v2.0. A more complete version of ParaBoost will be presented with the introduction of tokenomics v2.1, which will be released after Parallel V3.

Note: As ParaBoost is calculated entirely offchain, there will be no need to update smart contracts or perform new audits.

a. sPRL:

We propose to multiply by 2.5 the weight of sPRL2 relative to sPRL1 in the ParaBoost calculation. The calculation will be based on the dollar value of sPRL1 & sPRL2.

VI. Fee Distribution:

Currently, 80% of the fees generated by the protocol are distributed to the DAO treasury, and 20% are distributed to the parallel insurance fund. One of the major innovations we’re proposing with this new tokenomics is the redistribution of a portion of the fees generated by the protocol to PRL stakers (sPRL1 & sPRL2).

Fees accumulated during an epoch will be converted to PAR tokens on each chain where the protocol generates fees via a keeper, we propose to set Cooper Labs as the keeper; and then automatically bridged to the fee distribution chain; we propose to set Polygon PoS as the distribution chain. A portion of these fees will then be distributed to PRL stakers according to their ParaBoost. We propose to start by distributing 15% of generated fees to PRL stakers (can be updated in the future), meaning that PRL stakers would receive 15% of generated protocol fees in PAR at the end of each epoch to be claimed on Polygon PoS. Here is the new proposed generated protocol fees distribution:

The fees distributed to the PRL stakers will be distributed on the same chain, regardless of the chain where the PRL tokens are staked. Stakers will be able to claim their tokens during 12 epochs (≃1 year), after which the tokens will be automatically returned to the DAO treasury.

VII. Governance:

As explained in the proposal proposing MIMO → PRL token upgrade, the vMIMO would be unlocked to enable migration. Keeping the vMIMO as a voting token for future governance votes would therefore be impossible.

We propose to allow sPRL1 and sPRL2 holders to have voting power in the future, calculated via the ParaBoost of the previous epoch. In addition, we also propose to adjust the quorums for each type of proposal, with amounts that we judge to be low for the time being, due to the unknown effects of the new tokenomics. They may however be adjusted in the future via a new proposal:

- Parallel Integration Request: 100,000 sPRL (ParaBoost)

- Parallel Governance Proposal: 200,000 sPRL (ParaBoost)

- Parallel Improvement Proposal: 300,000 sPRL (ParaBoost)

The amount of sPRL (ParaBoost) required to publish a proposal on Snapshot would also be set to 100,000 sPRL (ParaBoost).

VIII. Audits:

The Parallel tokenomics codebase has been extensively audited by 2 different audit companies:

Audit costs were advanced by Mimo Labs, for a total of $79,500 (see BailSec invoice 1,BailSec invoice 2, Zenith invoice). We propose that the DAO retroactively compensate the full cost of the audits.

Means:

- Human Resources: Multisig signers will need to sign transactions to execute the proposal.

- Treasury Resources: $79,500 worth of PAR/paUSD/USDC (depending on DAO Treasury holdings) on Ethereum.

Technical implementation:

On Ethereum, Parallel DAO multisig will call following smart contracts:

-

Transfer $79,500 worth of PAR/paUSD/USDC (depending on DAO Treasury holdings) to 0xA804F6b4b6d0d9644811b45fe7eA389928786430 (Mimo Labs)

-

Deploy AccessManager contract

-

Deploy the sideChainFeeCollector contract

-

In the PAR FeeDistributor contract, call ‘changePayees’ function with these parameters:

- ‘_payees’: 0x25Fc7ffa8f9da3582a36633d04804F0004706F9b (Ethereum Parallel DAO Multisig); 0x6aF71a3723D3c0Ed69f84EE259c9De3019C2a77c (Ethereum Insurance Fund Multisig), sideChainFeeCollector contract

- ‘_shares’: 6500; 2000; 1500

-

In the paUSD FeeDistributor contract, call ‘changePayees’ function with these parameters:

- ‘_payees’: 0x25Fc7ffa8f9da3582a36633d04804F0004706F9b (Ethereum Parallel DAO Multisig); 0x6aF71a3723D3c0Ed69f84EE259c9De3019C2a77c (Ethereum Insurance Fund Multisig), sideChainFeeCollector contract

- ‘_shares’: 6500; 2000; 1500

-

Deploy sPRL1 contract

-

In the sPRL1 contract, set withdrawal start penalty to 50%

-

In the sPRL1 contract, set fee penalty recipient address to 0x25Fc7ffa8f9da3582a36633d04804F0004706F9b (Parallel DAO Multisig)

-

Deploy sPRL2 contract

-

In the sPRL2 contract, set withdrawal start penalty to 50%

-

In the sPRL2 contract, set fee penalty recipient address to 0x25Fc7ffa8f9da3582a36633d04804F0004706F9b (Parallel DAO Multisig)

-

In the sPRL2 (once Balancer & AURA 80/20 PRL/wETH pool deployed) update PoolId

On Polygon PoS, Parallel DAO multisig will call following smart contracts:

-

Deploy AccessManager contract

-

Deploy MainFeeDistributor contract

-

In the PAR FeeDistributor contract, call ‘changePayees’ function with these parameters:

- ‘_payees’: 0x2046c0416A558C40cb112E5ebB0Ca764c3C5c32a (Polygon PoS Parallel DAO Multisig); 0x2C6A1D01057258281eFE31bB34Bc0Df24C13086e (Polygon PoS Insurance Fund Multisig), sideChainFeeCollector contract

- ‘_shares’: 6500; 2000; 1500

-

In the paUSD FeeDistributor contract, call ‘changePayees’ function with these parameters:

- ‘_payees’: 0x2046c0416A558C40cb112E5ebB0Ca764c3C5c32a (Polygon PoS Parallel DAO Multisig); 0x2C6A1D01057258281eFE31bB34Bc0Df24C13086e (Polygon PoS Insurance Fund Multisig), sideChainFeeCollector contract

- ‘_shares’: 6500; 2000; 1500

-

Deploy RewardMerkleDistributor contract

-

Deploy sPRL1 contract

-

In the sPRL1 contract, set withdrawal start penalty to 50%

-

In the sPRL1 contract, set fee penalty recipient address to 0x2046c0416A558C40cb112E5ebB0Ca764c3C5c32a (Parallel DAO Multisig)

On Base, Parallel DAO multisig will call following smart contracts:

- Deploy AccessManager contract

- Deploy the sideChainFeeCollector contract

- Deploy sPRL1 contract

- In the sPRL1 contract, set withdrawal start penalty to 50%

- In the sPRL1 contract, set fee penalty recipient address to [contract to be deployed] (Parallel DAO Multisig)

On Sonic, Parallel DAO multisig will call following smart contracts:

- Deploy AccessManager contract

- Deploy the sideChainFeeCollector contract

- Deploy sPRL1 contract

- In the sPRL1 contract, set withdrawal start penalty to 50%

- In the sPRL1 contract, set fee penalty recipient address to [contract to be deployed] (Parallel DAO Multisig)

Voting Options:

- For the Tokenomics v2.0

- Against/Rework the proposal

- Abstain

Author(s): Cooper Labs

Sentiment poll:

- For the Tokenomics v2.0

- Against/Rework the proposal

- Abstain